POCAHONTAS COUNTY ASSESSOR

99 Court Square, Suite 2

Pocahontas, IA 50574

[Get Directions]

Mon-Fri: 8:00 am - 4:00 pm

Phone: 712-335-5016

Fax: 712-335-3143

Click below to view form/document.

We’ve received many questions regarding the recent 2025 Real Estate Assessment Notices, particularly about ag properties.

In Iowa, the assessed value of ag properties is not based on market value. Instead, it’s determined by a productivity value using a 5-year rolling average. For your 2025 assessments, this 5-year period is 2019-2023.

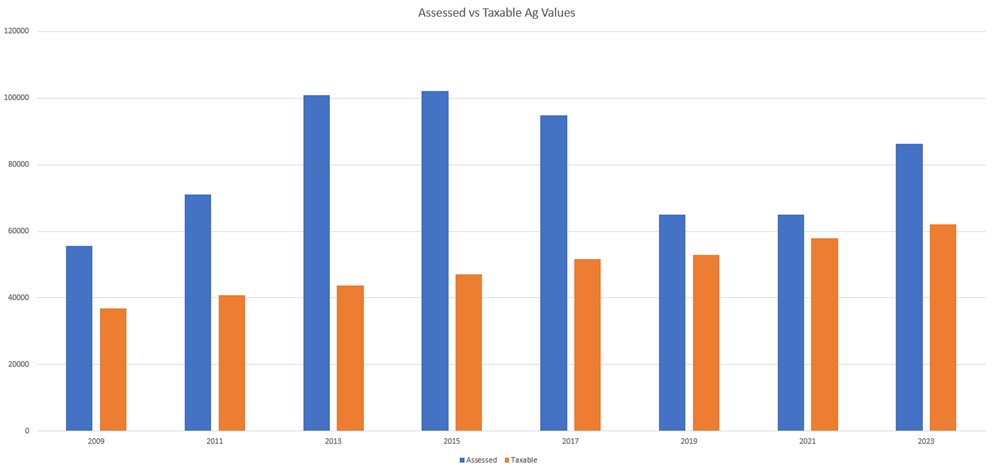

Many ag properties in Pocahontas County saw an increase of around 40% in their assessed values this year. However, a 40% increase in assessed value does NOT mean a 40% increase in your taxable value.

To help explain, I’ve created a chart using REAL assessed & taxable values of a 40-acre parcel in Pocahontas County from 2009-2023. You’ll notice that while assessed values may rise & fall, taxable values will typically not see those dramatic changes year to year.

If you have further questions on the process, feel free to call your local assessor’s office. We hope this helps clarify and ease concerns about the changes in ag property assessments.

- Family Farm Credit Filing Deadline is November 1 of each year.

- July 1 is the deadline for filing for the Homestead Credit, Homestead 65+ Exemption, and Military. If you are not currently receiving this credit and think you might be eligible, please call the Pocahontas County Assessor at 712-335-5016.

- Click here to watch a video published by the Assessor's Association that covers the TAXABLE and ASSESSED value changes on Agricultural property for the 2019 assessment year.

About the Department

Department Duties

The assessor is charged with several administrative and statutory duties. The primary duty and responsibility is to cause to be assessed all real property within their jurisdiction except that which is otherwise provided by law. This would include: residential property, commercial property, industrial property & agricultural classes of property. The effective date of the assessment year is January 1st of the current year. The assessor determines a full or partial value of new construction, or improvements depending upon the state of completion as of January 1st.

Misconceptions of the Assessor's Office

The Assessor does NOT: collect taxes, calculate taxes, determine tax rates or set policy for the Board of Review.

Important Dates

- January 1 - Effective date of current assessment.

- April 2 thru April 30 inclusive - Protest of assessment period for filing with the local Board of Review.

- May 1 thru adjournment - Board of Review meets each year.

- October 16 thru October 25 inclusive - Protest period for filing with Board of Review on those properties affected by changes in value as a result of the Director

Exemptions & Credits

Iowa law provides for a number of exemptions and credits, including Homestead Credit and Military Exemption. It is the property owner’s responsibility to apply for these as provided by law. If the property you are occupying as a homestead is sold, or if you cease to use the property as a homestead you are required to report this to the assessor in whose jurisdiction the property is located.

General Information

What is Market Value? Market Value of a property is an estimate of the price that it would sell for on the open market on January 1st of the year of assessment.

How does the Assessor estimate Market Value? To estimate the market value of your property, the Assessor generally uses three approaches:

- MARKET APPROACH - comparing properties that are comparable to yours which have sold recently.

- COST APPROACH – estimating the cost of what it would take to replace your property with one similar to it.

- INCOME APPROACH - an estimate of the income produced from the use of the property.

Why does the value change? State law requires that all real property be reassessed every two years. The current law requires the reassessment to occur in odd numbered years. Changes in market value as indicated by research, sales ratio studies and analysis of local conditions, as well as economic trends both in and outside the construction industry, are used in determining your assessment.

Property Owner’s Legal Responsibility

It is your legal responsibility to report to the Assessor changes or improvements to your real estate. 441.24(1) Code of Iowa provides:

If a person refuses to furnish the verified statements required in connection with the assessment of property by the assessor, or to list the corporation’s or person’s property, the director of revenue and finance or assessor, as the case may be, shall proceed to list and assess the property according to the best information obtainable and shall add to the taxable valuation one hundred percent thereof, which valuation and penalty shall be separately shown, and shall constitute the assessment; and if the valuation of the property is changed by a aboard of review or on appeal from a board of review, a like penalty shall be added to the valuation thus fixed.

There are many things you should report to your local assessor like:

-

- New Buildings

- Buildings removed, torn down or damaged by fire or flood

- Remodeling (interior & exterior)

- Additions to house or buildings

- New furnace / central air

- Fireplaces

- Basement or attic finish

- Decks, patios, and garages